The difference between shame and guilt, is the difference between ‘I am bad’ and ‘I did something bad’.

-Brené Brown

A little boy is at school laughing with some friends. He has pretty good relationships at school. He’s funny and can make people laugh. School comes easy to him, so he’s able to help people with their homework. He’s pretty fast and good at hand sports, so he likes to be active with others. He reads pretty well and likes to learn from others who share his hobby of reading comic book characters.

When he leaves school, though, he is mostly a loner. There are a couple of kids in the neighborhood that he hangs out with, but he never hangs out with kids from school. While in school, he would overhear others talking about sleeping over at each other’s houses. He is never invited over to anybody’s house. The flipside, though, is that he never invites people over to his place.

It seems to him that all of the kids at school live in large houses in fancy areas of town that have fancy names. The story he tells himself is that when kids stay over at each other’s houses, they stay up all night in large basements playing Sandbox and drinking Ribenna and Lucozade. He doesn’t have a large basement, nor a Sandbox, nor a mansion.

He doesn’t invite people over because he is somewhat ashamed. He wonders what would happen if they said no. He wonders what they will tell all the other kids when they find out he lives in a bungalow and not a mansion. What would they think of him if they find out he has no Sandbox and no Ribenna or Lucozade drink?

Shame kept this little boy from having more friends than he did. He wrapped himself in a shame bubble.

I know that little boy well because that boy was me.

WHAT IS SHAME?

According to Karen Reivich and Andrew Shatte in their book The Resilience Factor, shame is related to beliefs about being a bad person. It’s about character rather than behavior. People who are ashamed tend to be people who characterize themselves as being flawed or imperfect. In addition, they think that it’s their fault.

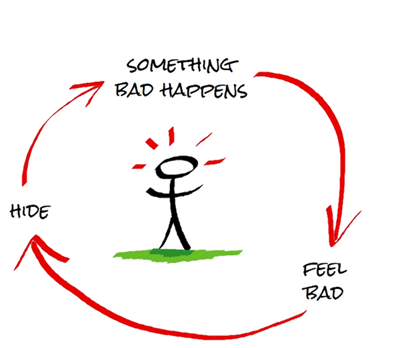

Shame is toxic and, to the extent we have any control over it, ought to be avoided at all costs. It causes helplessness and powerlessness and gives people an external locus of control, making them think that their lives are outside of their control. It tends to get people into a downward spiral that’s hard to get out of.

SHAME ENHANCING THE INCENTIVE VALUE OF MONEY

Shame leads to devaluation of the social self, and thus to a desire to improve self-esteem. Money, which is related to the notion of one’s ability, may help people demonstrate competence and gain self-esteem and respect from others. Based on the perspectives of feelings-as-information and threatened ego, I tested the hypothesis that a sense of shame heightens the desire for money, prompting self-interested behaviors as reflected by monetary donations and social value orientation.

The results showed that subjects in the shame condition donated less money (Experiment 1) and exhibited more self-interested choices in the modified decomposed game (Experiment 2). The desire for money as reflected in overestimated coin sizes mediated the effect of shame on self-interested behavior. My findings suggested that shame elicits the desire to acquire money to amend the threatened social self and improve self-esteem; however, it may induce a self-interested inclination that could harm social relationships.

SHAME VERSUS GUILT

Shame is a close relative of guilt. Both shame and guilt have to do with people wishing that something was a little different. Often they wish there was something that they could change in the past. The difference, though, is that guilt is about a particular behavior. Somebody who feels guilt feels like they have done something bad. Shame is about being a bad person.

Both of them are uncomfortable, but guilt is easier to rectify. Guilt points us to something that we can do. Guilt tells us there’s somebody we can apologize to or something we can stop doing. Shame doesn’t have a specific behavior attached to it. If you don’t have a specific behavior attached to it, you don’t know how to rectify it as easily as it would have been.

LOOK FOR GUILT

Guilt and shame are often used interchangeably. If you’re feeling uncomfortable feelings and think it’s shame, it might be worth trying to see if you can find some guilt. Guilt is better for you. Guilt will give you a problem to solve; a challenge that you can try to overcome.

CHALLENGE AUTOMATIC THOUGHTS

Often people feel ashamed or embarrassed because they see themselves as a failure at a deep level. These feelings are often driven by automatic thoughts. Our automatic thoughts are almost always going to skew negative, and that’s because of our ingrained negativity bias. It takes work to overcome this negativity bias, but it starts with trying to get a handle on what story you’re telling yourself. In other words, what money scripts in financial therapy are driving the thoughts about shame? Once you know what your actual belief is, you can challenge those beliefs and those automatic thoughts. You can ask yourself if you’re overgeneralizing, for example, or catastrophizing. Sometimes it’s difficult to challenge beliefs when they are yours, so you can ask yourself what advice you would give a close friend if that person came to you with the exact same situation.

FOCUS ON WHAT YOU CAN CONTROL

It’s helpful to remember that you can’t change anything that’s happened in the past. The only thing you can do is learn from it. It’s also reassuring to learn that many things are outside of our control. For example, you can’t change the cards you were dealt in life; that is outside your control. What is in your control is how you play the hand; you can change what you do going forward.

Shame is menacing. Once we get into a shame cycle, it’s hard to get out of. It’s helpful to try to reframe our shame as guilt if at all possible. If we can point to a specific behavior or set of behaviors that we’ve done, then we can do something to rectify what we’ve done. Shame is often driven by automatic beliefs that are tilted towards the negative side. Learning to understand and challenge these automatic beliefs will help us determine if we are jumping to the wrong conclusions. Finally, remember that some things are in your control and some things are not. Take responsibility for those things that are in your control and let go of things that are not. You can’t change the past, but you can do something today and tomorrow to alter your future.

What will you do?