As any other parent, you may be wondering how you can set your children up for financial freedom “process by process without getting naive” on whether they’ll catch up.

Coming out of the COVID-19 crisis might be a time to consider sharing valuable life-lessons about money with your children.

And when we think about July 2021 being “Make a Difference to Children” month, life lessons about handling money are perfect to share!

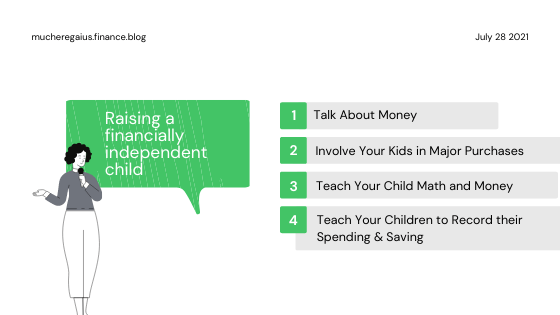

Here are some tips that will show you how to raise a financially independent child.

Talk About Money

Let’s change the narrative around money. You can introduce the concept of money to your kid at an early age. As your child grows, continue to deepen the conversation and help him or her understand the concepts of money.

If your unsure of where to start, you can also ask a trusted friend or family member to have these conversations with your child. It’s also ok to let your child know that you don’t have it all figured out. Explain the things you’ve done and what you would or wouldn’t do again and why. Sharing is how we learn!

Involve Your child in Major Purchases

Deciding where to go on vacation? Buying a new appliance? Include your kids in the process. They can help with the research. You can show your child the factors that go into making the decision. You can help him or her compare the options before making the purchase. Even better, allow your child to pay for the major purchase. Imagine how your child will feel knowing they did the research to make the best decision for the entire family. Just imagine that!!!

Teach Your Child Math and Money

Most people don’t learn about budgeting until it’s too late. Imagine what the future will look like for your child, if you teach him the value of savings today. Show them how compound interest works or much more if you don’t know about it, talk to a friend or family member to take them through indirectly under your guidance. When you go to the store, could you give your child a UGX 100,000 bill and ask them to purchase part of the grocery list? When could you teach your child about credit? Could you educate him about how ATM cards work before they go to college?

Teach Your Children to Record their Spending & Saving

I personally my dad used the envelope system. He taught me to write my spending on a receipt and then separate out my money, based on different expenses, into envelopes. My mom used a small notebook to record her spending and saving. To this day, my mom still carries that small notebook in her small African hand bag. She records her pay, spending, and net worth. Watching my parents instilled this practice in me.

Remember the main reason for teaching your child about how to track their spending is to allow them to better understand where their money goes. More importantly, this allows your child to successfully handle his money and achieve his goals.

Don’t worry, teaching your child about money doesn’t have to be a daunting task. If you’re like most people, the hardest thing to do is to start the conversation.

This is a good piece Gaius. Been following your articles from a workmate friend here in Pretoria and wouldn’t resist referring the same to my family. I think we need a one on one talk. Kindly contact me on +27 86 645 5644

LikeLiked by 1 person

Mary am glad you loved this too.

Sure, I’ll get in touch soon!

LikeLike

Great piece if information @MuchereGiaus for us the young parents to instill culture into our children at early stage

LikeLiked by 1 person

Thank you Sir. Hillary for sparing time and read this piece too. Am glad you enjoyed it 😊

LikeLike

This is really insightful Muchere. With the bond and stock selection advise I got from you in January even through this pandemic times, I’d like to happily tell you that my portfolio is properly managed in Kenya. I can’t regret any penny invested

LikeLike